|

|

马上注册,精彩即将继续...

您需要 登录 才可以下载或查看,没有帐号?立即注册

x

本帖最后由 red 于 2015-7-22 21:25 编辑

Advanced achieves revenue of $20.1 million in 1Q2015 2015年第一季度,爱文思业绩达到2010万美金

- Disposal of non-core water treatment business approved by Shareholders on 13 May 2015

- Maintains a healthy order book of $91 million as at 31 March 2015

- A healthy cash reserves of $18 million

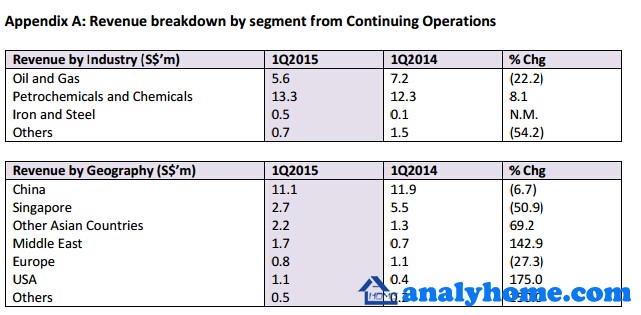

SINGAPORE – 14 May 2015 – Advanced Holdings Ltd. (“Advanced” or the “Group”), a global supplier

of proprietary process equipment, clean energy solutions and related technologies, today reported

a revenue of $20.1 million from continuing operations for the three months ended 31 March 2015

(“1Q2015”).

The Group remained profitable at the baseline, with a net profit attributable to owners of the

Company of $0.1 million from both its continuing and discontinued operations, the latter of which

comprises its water treatment business in China.

Faced with a challenging operating environment and intensified competition, the Group recorded a

net loss of S$0.3 million from its continuing operations.

The disposal of the water treatment business was approved by Shareholders at an Extraordinary

General Meeting on 13 May 2015. With completion of the transaction expected by June 2015, the

Group believes its exit from the water treatment business will allow it to maximize returns to

shareholders as well as re-strategize its financial and capital resources.

Based on this set of results, the Group posted an Earnings Per Share (“EPS”) of 0.04 cents in 1Q2015

compared to an EPS of 0.2 cents in 1Q2014. The Group recorded an improved Net Asset Value

(“NAV”) per share of 23.99 cents as at 31 March 2015, compared to 23.52 cents as at 31 December

2014.

Outlook

The Group expects business and operating conditions to remain challenging in 2015 and will continue

to face downward pressure on its operating margins. Given the weakness in oil prices, China oil

majors and international oil companies are tightening their budgets and cutting back on capital and

maintenance expenditure. Coupled with this, competition in the market is likely to be stiffer with

customers taking a longer time to make a decision on buying while some projects may be postponed

or cancelled. In addition, the volatility of the US Dollar and Euro has increased uncertainty in this

region while the recent increase in SIBOR has raised the costs of financing.

|

|